Our materiality, material risks and opportunities

Determination of materiality

The matters included in our integrated annual report are principally aimed at providers of financial capital in order to support their financial capital allocation assessments. The interests of the providers of financial capital are, however, largely aligned with other key stakeholders in that they also are focused on the creation of value in the long term.

In determining which matters are material for disclosure in our integrated annual report we have considered whether the matter substantively affects, or has the potential to substantively affect, our strategy, our business model or the forms of capital we utilise and ultimately our ability to create value over time.

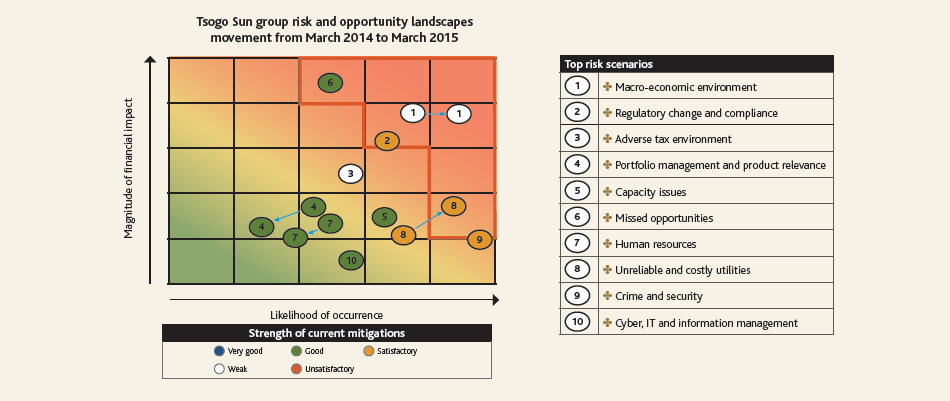

The assessment of the magnitude of the impact and the likelihood of the occurrence of the group’s top risks and opportunities included below informed the identification and prioritisation of the material matters for inclusion in the integrated annual report. The matters identified were compared with those being reported on by organisations in the same or similar industries to ensure that relevant matters have not been excluded from the report.

Material risks and opportunities

The risk management process followed in identifying the group’s top risks and opportunities is included in the Corporate governance section. The matrix reflecting the assessment of movement in the magnitude of the impact and the likelihood of the occurrence of the group’s top risks and opportunities over the year is as follows:

The principal risks and opportunities facing the group and considered by the board are detailed below:

| Principal risk landscapes | Specific risks we face | Potential impact | Risk responses | Associated strategic priorities | ||||

Macro-economic environment

|

|

|

|

|

||||

Regulatory change and compliance

|

|

|

|

|

||||

Adverse tax environment

|

|

|

|

|

||||

Portfolio management

|

|

|

|

|

||||

Capacity issues

|

|

|

|

|

||||

Missed opportunities

|

|

|

|

|

||||

Human resources

|

|

|

|

|

||||

Unreliable and costly utilities

|

|

|

|

|

||||

Crime and security

|

|

|

|

|

||||

Cyber, IT and information management

|

|

|

|

|

||||