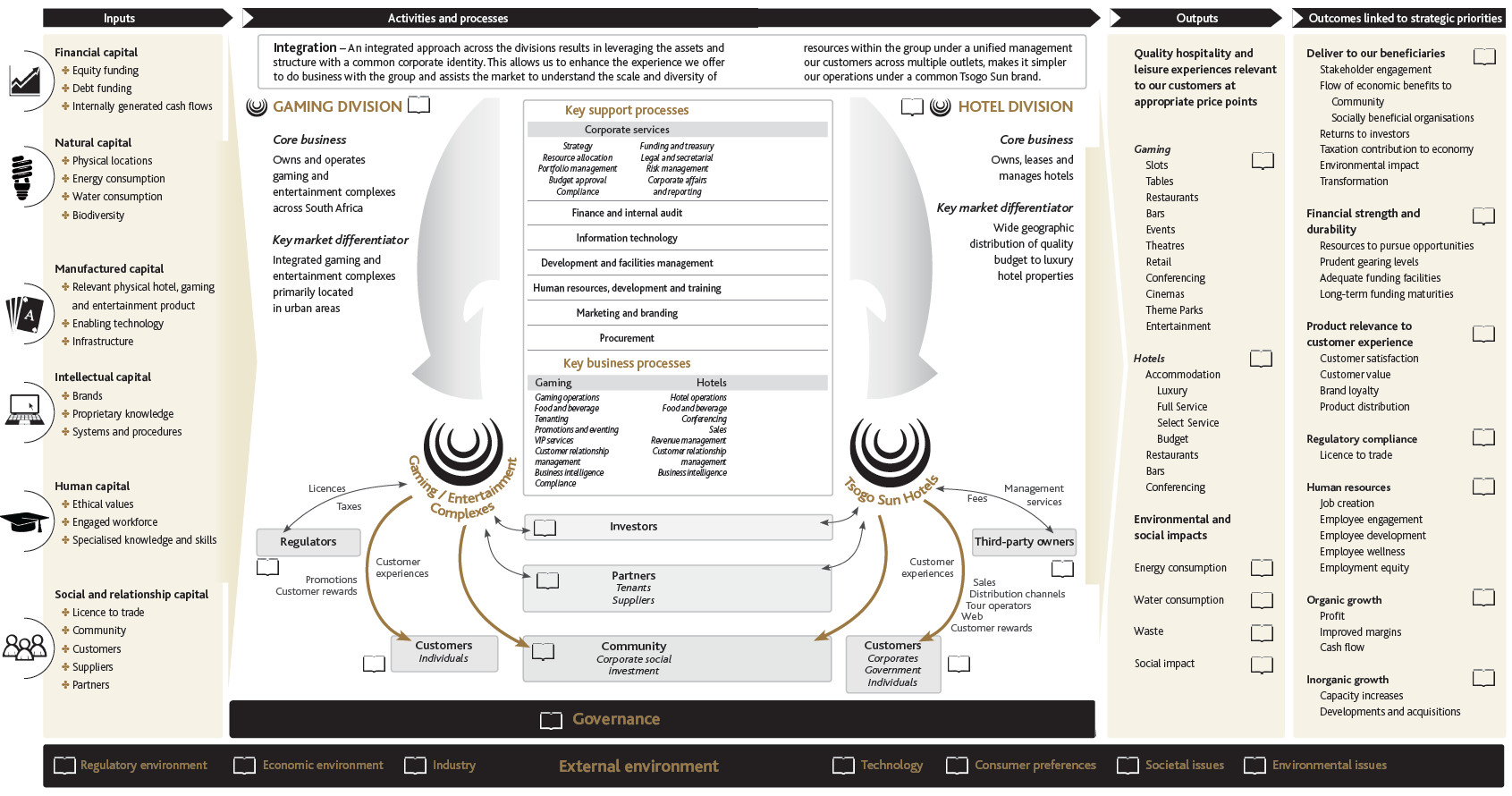

Our business model

We create value through the operation of quality assets in leading locations in key markets and by investing in and building our portfolio across a range of consumer segments.

Click the below image to view a larger version

TSOGO SUN GAMING

Key features

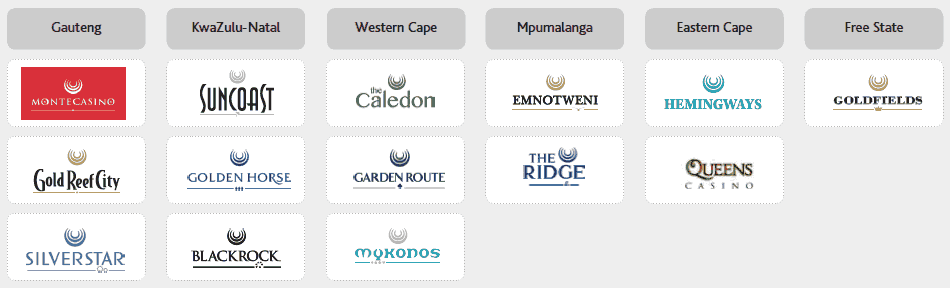

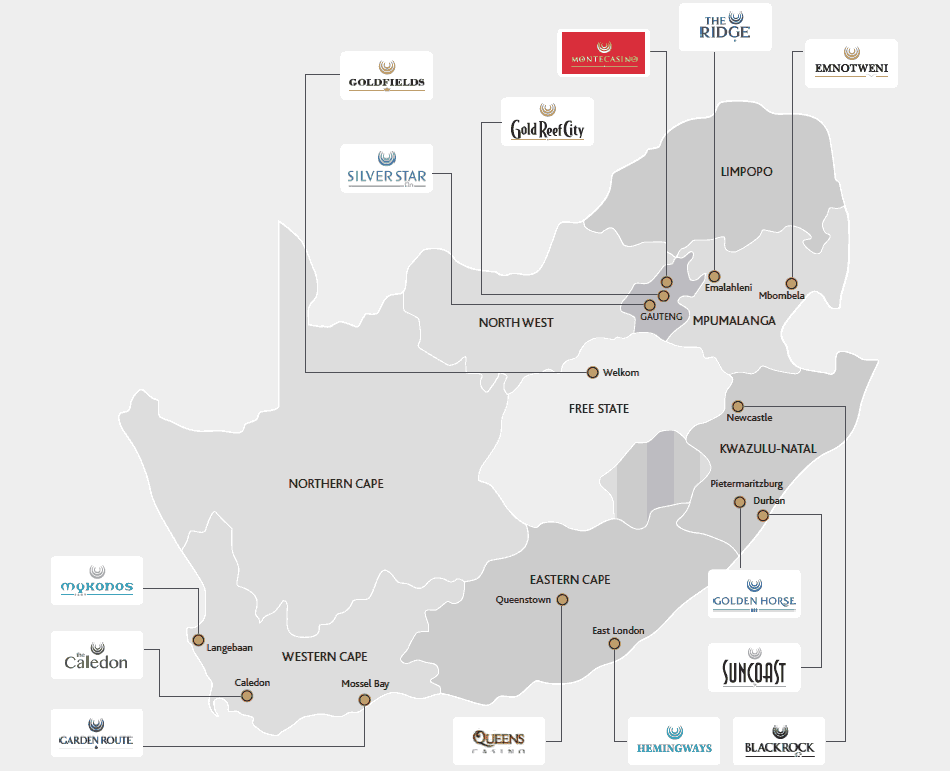

The group’s preference is to wholly own its operations thus creating a clearer, simpler operating structure. Empowerment shareholding is achieved at the holding company level, enabling the group empowerment shareholders to participate in all casino operations. Exceptions arise from historical structures and, in the Eastern Cape, where the gaming legislation requires local provincial-based empowerment ownership. Ten of the 14 gaming operations of the group are wholly owned with minority shareholders in Hemingways (35%), Blackrock (2%) and Mykonos (30%), and with Queens Casino being an associate investment of 25%. During the year, the group acquired the remaining minority interest in Garden Route which is now wholly owned.

The gaming and entertainment complexes are primarily located in urban areas and are the entertainment hubs for the communities they serve. The businesses are thus embedded within the local communities and their success is inextricably linked to the economic wellbeing of that community.

Along with the creation of local jobs and the payment of taxes, we seek to stimulate local enterprise and support economic development, collaborate with provincial and national government and others on shared challenges – all essential to our ongoing ability to trade.

Significant focus is placed on the nature and quality of the facilities and experiences offered at each gaming and entertainment complex. With the vast majority of customers being locally based regular customers, an important component of our operating model is to ensure the properties remain fresh, attractive and interesting to visitors on an ongoing basis.

Management of mutually beneficial relationships with quality restaurant, retail and entertainment tenants is key to retaining footfall at our properties against other leisure offerings.

The customer reward programme in the gaming division rewards customers with status, benefits and recognition. The rewards programme is important as 72% of gaming revenue is contributed by active reward club members.

Compliance with gaming regulations is critical to the retention of the casino licences and is discussed in the regulatory compliance section.

Brands

Footprint

| Ownership % |

as at 31 March 2015 | Group revenue contribution % |

Group Ebitdar contribution % |

|||

| Tables | Slots | Hotel rooms | ||||

| Montecasino | 100 | 79 | 1 820 | 619 | 22 | 27 |

| Suncoast | 100 | 63 | 1 545 | 165 | 14 | 17 |

| Gold Reef City | 100 | 50 | 1 712 | 113 | 11 | 11 |

| Silverstar | 100 | 28 | 1 102 | 34 | 6 | 6 |

| The Ridge | 100 | 18 | 450 | 175 | 4 | 4 |

| Hemingways | 65 | 16 | 507 | 108 | 3 | 3 |

| Emnotweni | 100 | 18 | 425 | 224 | 3 | 4 |

| Golden Horse | 100 | 20 | 450 | 96 | 3 | 4 |

| Garden Route | 100 | 16 | 412 | 43 | 2 | 2 |

| Goldfields | 100 | 9 | 250 | – | 1 | 1 |

| Blackrock | 98 | 10 | 300 | 80 | 1 | 1 |

| The Caledon | 100 | 8 | 318 | 95 | 1 | 1 |

| Mykonos | 70 | 6 | 320 | – | 1 | 1 |

| Queens | 25 | 6 | 180 | – | * | * |

| Other gaming operations | 100 | – | 1 | (5) | ||

| Total | 347 | 9 791 | 1 752 | 73 | 78 | |

| Notes * | Queens Casino is equity accounted |

| Ebitdar is stated pre-management fees |

TSOGO SUN HOTELS

Key features

Tsogo Sun hotels does not follow the prevalent international trend of operating the business on an ‘asset light’ basis, and in South Africa, the portfolio philosophy remains to majority own all the components of the business, wherever possible. The components of the hotel business are land, buildings, operations, management and brand. Although this portfolio philosophy is more capital intensive than the ‘asset light’ model, it allows substantially higher return on effort and in the long term retains control of the assets providing security of tenure and resilience through trading cycles.

The group leases assets both in South Africa and offshore where it is not possible to own the land and buildings, but then loses the growth of the property value over time. In South Africa the group will only manage operations for third parties if they are strategically important (due to partner requirements or location) and where there is no option to own or lease. We will manage operations for third parties offshore as this is a low risk option to enter new markets, but in the longer term it would be preferable to own the operation and the property. We operate hotels as a franchisee where necessary due to brand differentiation requirements but we are not a franchisor of our own brands.

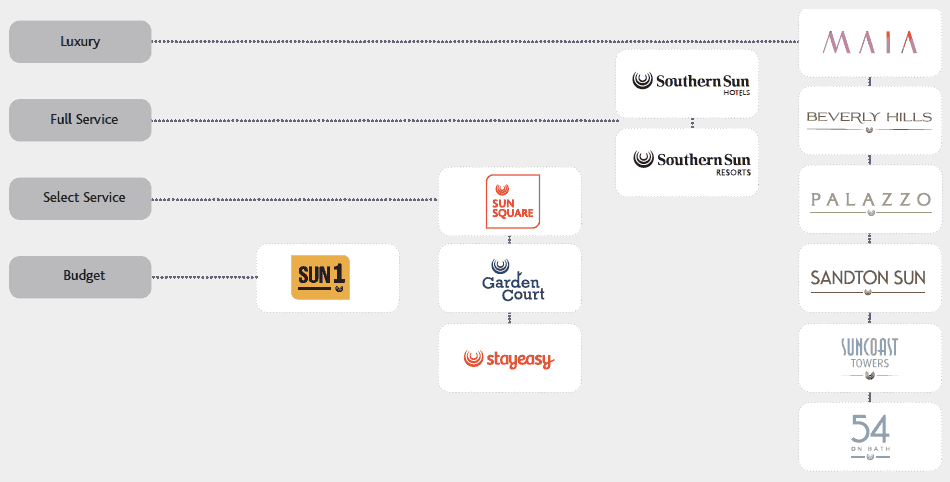

Tsogo Sun hotels’ key differentiator in South Africa is our wide distribution of quality, budget through to luxury, hotel products. In addition to quality product, consistent exceptional guest experience remains the focus at all Tsogo Sun hotels to differentiate in an often commoditised industry.

The majority of Tsogo Sun hotels’ occupancy depends on the business traveller, government and group and convention markets. Relationships with key customers and travel intermediaries, and access to the correct distribution networks, are critical in driving both occupancies and average room rates throughout the hotel division.

The customer reward programme in the hotel division is important as 29% of hotel revenue is contributed by active reward club members.

Brands

Each luxury hotel offers guests world-class style, unparalleled service and accommodation and signature touches that define luxury travel. The full service hotels offer products and services that meet the needs of tomorrow’s savvy global travellers, whether travelling for business or leisure. Our select service hotels delight the self-sufficient traveller with what is needed for a good level of comfort and productivity at great hotels at great rates. Our budget hotels provide easily accessible basic accommodation and can be relied on for a great night’s rest at the right price. The group is unique in Africa in providing world-class accommodation across all market segments.

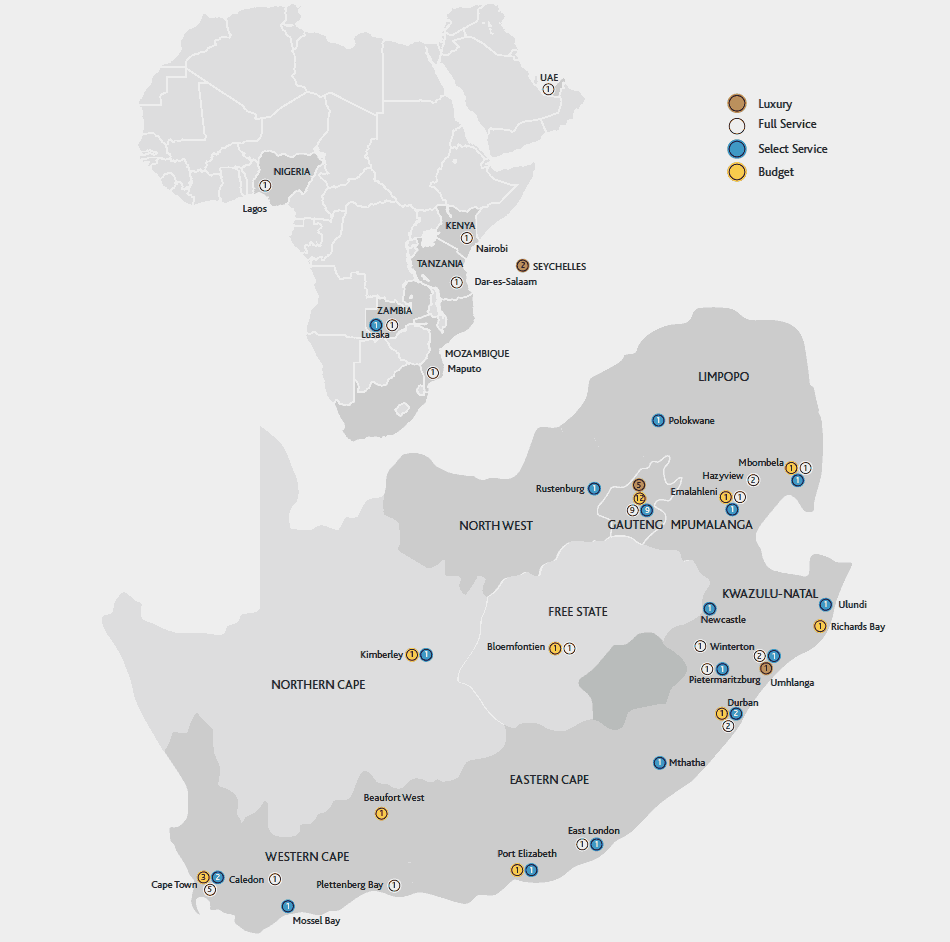

Footprint

| as at 31 March 2015 | ||||||||

| Owned/Leased | Managed | Total | Group revenue contribution % |

Ebitdar contribution % |

||||

| Hotels | Rooms | Hotels | Rooms | Hotels | Rooms | |||

| Luxury | 3 | 410 | 3 | 703 | 6 | 1 113 | 2 | 1 |

| Full Service | 24 | 4 703 | 4 | 854 | 28 | 5 557 | 11 | 9 |

| Select Service | 22 | 3 930 | 4 | 847 | 26 | 4 777 | 8 | 8 |

| Budget | 23 | 1 690 | – | – | 23 | 1 690 | 1 | 2 |

| South Africa | 72 | 10 733 | 11 | 2 404 | 83 | 13 137 | 22 | 20 |

| Offshore | 7 | 1 053 | 2 | 483 | 9 | 1 536 | 5 | 2 |

| Total | 79 | 11 786 | 13 | 2 887 | 92 | 14 673 | 27 | 22 |

THE ENVIRONMENT WITHIN WHICH WE OPERATE

Regulatory environment

The South African regulatory environment continues to become more complex with the ongoing introduction of new legislation rulings, practices and policies. Gaming legislation remains the group’s primary compliance focus although this regulatory framework is well entrenched and remains relatively stable.

The main regulatory areas of concern are potential amendments to smoking legislation and the amendments to the BBBEE Codes of Good Practice. The total ban on smoking in public places has had a significant short-term impact on gaming win in other countries where it has been implemented, although the impact in South Africa may not be as severe due to the strict smoking restrictions that are already in place. The amendments to the BBBEE Codes of Good Practice are important particularly in the context of various gambling boards seeking to impose the achievement of defined levels of empowerment, as measured against the codes, as a licence condition.

Proposed amendments to the National Liquor Act and the Financial Intelligence Centre Act may also impose more onerous and/or impractical obligations on the group. The liquor amendments include restrictions to whom alcohol may be sold, the restriction of trading hours and restrictions regarding where licensed premises may be located, and the imposition of vicarious liability on licensees. The FICA amendments include the broadening of the “business relationship” definition and the introduction of the concept of “prominent influential persons/public officials”.

The gaming industry in South Africa is highly regulated, both at national and provincial level, and thus, unlike the hotel industry, has high barriers to entry. The National Gambling Act sets the broad framework for the licensing and regulation of gambling in South Africa, but each province has its own legislation relating to casinos, gambling and wagering. The National Gambling Act limits the number of casino licences that may be granted to 40 for South Africa as a whole. The table below sets out details in respect of the number of casino licences in South Africa which are authorised to be issued, have been issued and are available to be issued:

| Province | Authorised to be issued |

Issued | Tsogo | Available |

| Gauteng | 7 | 7 | 3 | – |

| Eastern Cape | 5 | 4 | 2 | 1 |

| Western Cape | 5 | 5(1) | 3 | – |

| Mpumalanga | 4 | 3 | 2 | 1 |

| Limpopo | 3 | 3 | – | – |

| Northern Cape | 3 | 3 | – | – |

| Free State | 4 | 4 | 1 | 1(2) |

| North West | 4 | 4 | – | – |

| KwaZulu-Natal | 5 | 5 | 3 | – |

| Total | 40 | 38 | 14 | 3 |

| (1) | The Western Cape provincial government is considering the relocation of an existing Western Cape casino licence to the Cape Metropole |

| (2) | One of the existing licences will lapse upon the issue of the one available licence |

In May 2015, the Minister of Trade and Industry published a draft National Gambling Policy which includes a proposal that the North West province be allocated an additional casino licence which potentially increases the risk of additional licences in other provinces.

The approval by the Gauteng Gambling Board of Sun International’s application to relocate its Marula licence to Menlyn in Pretoria potentially increases the likelihood of the relocation of other casino licences.

With the exception of the group’s Eastern Cape-based licences, casino licences are issued for an indefinite period, subject to payment to the relevant provincial board of the applicable annual licence fees and continued suitability and compliance with licensing conditions.

Economic environment

Disposable income growth, significant middle-class growth, developed infrastructure and an operating environment conducive to business have historically been long-term structural drivers of growth in South Africa and have increased the consumer base and spending power of the population. Disposable income in South Africa grew strongly since 2000 and millions of South Africans have entered LSM 5 to 10.

Global economic conditions following the financial crisis remain weak although they appear to be improving and sentiment-driven shocks continue to fuel volatility. Uncertainty impacts global fund flows to emerging markets which, exacerbated by lower commodity prices and South African-specific social and economic issues, have resulted in significant Rand weakness. The Rand weakness has the dual impact of driving local inflation and exerting upward pressures on interest rates, which reduces economic growth. Business confidence remains low, particularly due to the current constraints in electricity supply, with household debt at a high level and unsecured lending defaults continuing. Above-inflationary increases in municipal rates, electricity and water, in addition to the costs of mitigating the supply constraints, have had an impact on both businesses and the consumer.

The underlying operations of the group remain highly geared towards the South African consumer (in gaming) and the corporate market (in hotels). The weakening of the Rand mainly impacts the capital cost of gaming machines and the translation of the income statement of the hotels outside South Africa. We do not believe that the increased unsecured lending has driven growth in the gambling industry as it remains entertainment spend from upper/middle-income consumers, with the main beneficiary of the easy credit being retail sales, mainly clothes and furniture in lower-income segments. The factors noted above mainly impact the group indirectly due to their impact on the consumer and corporate markets and have manifested in significant monthly trading volatility with growth for the past 18 months relatively weak.

Industry

Gaming

A gaming industry has existed in South Africa since it was partially legalised in the independent homelands during the 1970s. Following the introduction of the current regulatory framework in South Africa during the late 1990s, the industry has been formalised and operates in line with global best practice. The formalisation of the industry has provided substantial benefits to the country through the collection of taxes, the development of gaming and entertainment complexes, hotels and tourism infrastructure, and the creation of employment.

The casino market reflected double-digit growth until 2008 when the impact of the global recession slowed growth. The industry proved to be resilient and although growth slowed to low single digits it never went significantly negative. Growth from 2010 has lagged nominal GDP but is expected to accelerate when economic conditions improve.

The South African formal gaming market is made up of casinos, the national lottery, sports betting, limited payout machines and bingo, and generates annual revenues of approximately R23 billion. Casino gaming accounts for in excess of 70% of the gaming market and Tsogo Sun has a revenue share of 46% in the six provinces in which it operates. As a result of their geographic distribution, casinos in South Africa mainly compete with providers of other leisure and entertainment activities for patronage, such as shopping centres, restaurants and sporting and concert venues, rather than with other casinos. The group has a significant presence in each of South Africa’s largest casino markets. The table below sets out the group’s estimate of its share of the total casino gaming win per province:

| For the year ended 31 March 2015 |

||

| Total casino gaming win Rm |

Group share of total casino gaming win % |

|

| Gauteng | 7 156 | 52 |

| KwaZulu-Natal | 3 200 | 59 |

| Western Cape | 2 787 | 16 |

| Eastern Cape | 1 197 | 25 |

| Mpumalanga | 764 | 82 |

| Free State | 477 | 25 |

| Other | 1 669 | – |

| Total | 17 250 | 41 |

Online gaming remains illegal in South Africa and there is no indication as to when enabling legislation will be implemented. There was no discernible impact from the banning of online gaming and it is not considered a significant risk. Limited payout machines and bingo continue to show stronger growth as they are rolled out by each province but to date appear to have had little impact on casinos as they are targeted at a different segment of gambler. What would be of concern to the casino industry is if the roll out was on an uncontrolled basis and resulted in a proliferation of large sites, particularly if the maximum bet and maximum payout limits were substantially increased.

Hotels

Following the first democratic elections in 1994 the demand for hotel rooms grew rapidly and rooms sold by the group grew by more than 6% per annum between 1994 and 1999. The market responded to the increased demand through the construction of new hotels but demand growth continued to exceed the growth in supply until 2008 with occupancies and average room rates continuing to rise. During 2008, the impact of the global recession constrained demand but construction of new hotels continued until the FIFA World Cup in 2010 as the projects were already in progress. Market occupancies fell from 72% in 2007 to 53% in 2011 due to the combination of constrained demand and increased supply. Demand has subsequently grown, and with little growth in hotel supply, market occupancies have been recovering since 2011 and are now above 60% although the fiscal austerity measures implemented by government constrained growth during the 2015 financial year. We anticipate that demand will continue to grow and that additional supply will again be added to the market when market occupancies approach 70%. The introduction of revised visa requirements is expected to have a significant impact on the volume of international inbound tourists and business travel to South Africa, particularly from China and India. The requirement to appear in person to submit biometrics for a visa was implemented in October 2014 and is problematic due to the limited locations where biometrics can be submitted (Beijing and Shanghai in China, and Delhi and Mumbai in India). The added requirement of an unabridged birth certificate for children was implemented in June 2015. The impact on the group is not expected to be significant as inbound travel is not a large segment of the group’s business.

Tsogo Sun hotels has a strong presence throughout South Africa and has a broad portfolio of hotels, particularly in urban centres. Of the approximately 150 000 hotel, bed and breakfast and guesthouse rooms available in South Africa, the formal hotels contributing statistics to STR Global make up approximately 30% of the total market, with 44 880 rooms available as at 31 March 2015. The group’s share of this formal market is approximately 30% and the group thus benefits from a significant presence in the South African hospitality industry and is the only hotel group in South Africa with wide distribution across all grading levels.

Trading in the majority of the African cities where Tsogo Sun hotels operates outside South Africa remained remarkably resilient through the economic downturn mainly due to limited supply of good quality hotels. Trading during the 2015 financial year was, however, significantly impacted by the Ebola pandemic and security concerns in various countries. The markets are small and the addition of a new hotel has a more significant impact on the market. It remains challenging and expensive to acquire land and build hotels in many countries in Africa which constrains supply. However, many of the countries are experiencing strong economic growth which will drive the demand for, and supply of, new hotels.

Technology

The use of technology is important in both the gaming and hotel businesses to deliver relevant experiences to customers and to drive business efficiencies. Key technology areas are gaming and hotel property management and hotel booking and reservation systems to enable the business, customer relationship management to provide relevant benefits and rewards to customers, business intelligence to drive efficiencies and digital platforms to interact with and provide connectivity to customers.

Relevant technology trends are as follows:- online booking volumes of hotel rooms continue to increase although they remain below international norms in South Africa;

- the increased utilisation of mobile devices and business applications, makes a mobile-friendly website an imperative;

- customer relationship management is increasingly important in encouraging customer loyalty, particularly due to potential gaming advertising restrictions and the Consumer Protection Act;

- social networking impacts marketing channels and requires transparent and timeous responses and active management;

- the importance of data security is increasing due to external threats, increased connectivity and POPI; and

- free broadband wireless access has become common.

Consumer preferences

In order for gaming and hotel businesses to deliver quality experiences, facilities and services must be relevant to what customers want and are prepared to pay for. Consumer preferences range from the technology preferences noted above to the look and feel of the physical product, the location of buildings, concepts of restaurants and bar offerings, types of entertainment and travel patterns.

Public recognition of brands and their associated reputation are important in attracting and retaining customers.

Societal issues

The weak economic environment, along with political factors, has fuelled labour unrest and disruption in a number of industries in South Africa. The expectations of unions for above-inflationary increases with extended periods of labour strikes have reduced disposable income. The disruption continues to discourage investment and impacts the high unemployment level and low growth rate in the country. The impact on the gaming and hotel businesses in the markets in which the group operates is limited due to the high level of employee engagement and the location of the majority of the properties in urban areas. The group is, however, indirectly impacted through the adverse effect on the economy.

The gaming industry is exposed to anti-gaming sentiment, which increases the risks of excessive taxation and regulation. The reality, however, is that the issues such as problem gambling are well managed and are substantially exceeded by the benefits in the highly regulated industry through significant tax contributions, infrastructure development, creation of employment, wealth distribution to black economically empowered businesses and PDI shareholders and social investment in the communities that are served. The negative impacts of casino gaming is also less of a societal issue than the other forms of gaming due to the ease of access and lower economic target markets of sports betting, limited payout machines (‘LPMs’), bingo and in particular the national lottery.

Environmental issues

The gaming and hotel businesses pose limited risks to the environment due to the service nature of the industry. In particular, Tsogo Sun operates predominantly in urban areas, which further reduces the biodiversity impact. The main environmental impacts are through the consumption of energy and water, the production of waste and travel to our properties.

Although customer choices are not yet significantly impacted by environmental performance, behavioural changes are being driven by social responsibility. The greater challenges to the industry currently are the rising utility costs and uncertainty of the future supply of energy and particularly of water.