Chairman’s and Chief Executive Officer’s review

DEARSTAKEHOLDERS

John CopelynChairman |

Marcel von AulockChief Executive Officer |

The 2015 financial year was in many ways a landmark year for the group, with the exit of long time shareholder, SABMiller, allowing a substantial increase in the free float of the company, and presenting the opportunity for an attractive buy-back of some 12% of the group’s shares.

| ✤ | Financial ability to withstand macro-economic shocks and still pursue significant attractive investment opportunities |

| ✤ | Strategic investment of R2.8 billion in the buy-back of shares concluded but disappointment with the cancellation of the acquisition of a 40% stake in the GrandWest and Worcester casinos |

| ✤ | BBBEE rating has been reaffirmed at level 2 although significant uncertainty exists as to the rating under the new codes |

| ✤ | Significant product initiatives carried out during the year include the major redevelopment of the Silverstar and Gold Reef City complexes and the focus on the food and beverage operations |

| ✤ | Employee engagement survey results were pleasing and indicate a healthy work environment |

| ✤ | Recovery in consumer and business confidence remains the largest growth opportunity for the group |

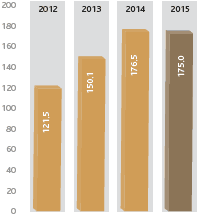

Adjusted HEPS (cents)

Overview

The year ended 31 March 2015 was a very difficult year for the group from a trading perspective. The flat results reflect a disappointing 2% growth in gaming win, exacerbated by a year that saw reduced government spend on travel, the impact of the Ebola pandemic on travel to many of the African markets, particularly Nigeria, and the closure of Southern Sun Maputo for renovations. The growth was slower than the growth achieved in the 2014 financial year and below our expectations, and is indicative of the tough macro-economic environment and particularly, poor consumer sentiment.

However, the 2016 financial year should reflect better growth as a result of the non-recurrence of some of the exceptional factors experienced during the year. After three years of strong growth in adjusted headline earnings per share, the 2015 financial year saw a marginal 1% decline to 175 cents per share with the dividend declared in respect of the year totalling 89 cents per share, flat with the prior year and in line with the group policy of declaring 50% of adjusted headline earnings per share.

The group should be in a position to continue delivering increased earnings and dividends, both through organic and expansionary activity over the medium term. The rate of growth is, however, largely reliant on the rate of recovery in the South African economy and the distinct caveats that we do not experience another recession and that the various regulatory authorities under which the group operates do not inhibit our ability to trade.

The group has continued to focus on its core growth strategy and pursued avenues to deploy capital at attractive rates of return. This remains a long-term strategy and patience will be required for the full benefits of these investments to be realised, particularly the investment in the upgrade and expansion of the group’s casino and hotel assets, as they are ultimately designed to cater for the increased demand that is generated by broader economic growth.

Disappointingly the deal to acquire a 40% stake in the GrandWest and Worcester casinos in the Cape province was cancelled in July 2015 as it became clear that we would be unable to conclude the regulatory process before the deadline for the transaction. Enhancing the group’s presence in the Western Cape gaming market remains an opportunity going forward.

Regulatory challenges continue to present risks to the group and we remain vigilant to these. These challenges are as varied as changes in BBBEE rules, corporate and personal taxes, FICA-related rules and more recently visa regulations, which have significantly impacted tourism to South Africa from the global growth markets of India and China. We continue to engage with government to try and ensure the impacts of proposed policy changes are understood and analysed before they are implemented.

Strategic priorities

The strategic priorities of the Tsogo Sun group remain sustainability and growth. Given the uncertain macro-economic outlook in South Africa in the short to medium term, sustainability is more important than ever, and is achieved through firstly avoiding mistakes that can threaten the survival and health of the business and secondly, identifying external risks and opportunities and developing mitigating strategies to minimise or eliminate the impact of the risks on the organisation and strategies to take advantage of the opportunities. Growth is achieved both organically and inorganically and is measured by the increase in the group’s free cash flow generated over time.

Sustainability

In order to take advantage of commercial opportunities that are presented, a business needs to first and foremost stay in business. Sustainability for Tsogo Sun is about the five major pillars of focus for ensuring the long-term survival and prosperity of the group. We continue to focus on and make good progress in each of these areas.

Financial strength and durability

Closing net debt to Ebitdar at 2.2 times remains comfortable and the increase in absolute net debt over the prior period to R9.2 billion includes the effect of the R2.8 billion share buy-back concluded at an attractive price of R20.96 per share.

The group’s committed debt facilities total R14.3 billion, some R4.8 billion above the current drawdown (including available cash on hand), and have an average tenure of almost five years. Accordingly, the group is adequately funded for ongoing operations and the macro-economic shocks that may occur and can take advantage of significant expansion opportunities.

Deliver to our beneficiaries

Given the perceived social impacts around gaming, it will always be important who owns us and who enjoys the economic benefit of the group’s activities through dividends, employment, taxes and social programmes.

During the 2015 financial year the group continued to enjoy a stable and supportive shareholder base in HCI, with a concentrated holding of 47.6% following the share buy-back which also resulted in a broadening of the shareholder base.

HCI continues to show a significant amount of support and enthusiasm for the group’s growth strategy and this has played a material part in assisting us to close a number of the important expansion opportunities. In addition, the introduction of the HNA group out of China as the largest buyer in the SABMiller share sale is expected to open new opportunities to the group in the future.

The group has consolidated its CSI and enterprise development activities under the concept of Citizenship. R154 million was spent on CSI initiatives in the key areas of education, sport and environmental awareness, while in enterprise development we have 98 guesthouses registered on our Book-a-Guesthouse programme, all black owned and 92% by women. As a group we have tried to focus on programmes that make a real difference in the communities we operate in, with the initiatives often coming from staff at the unit level.

With more than 22 000 people directly and indirectly employed by the group and R2 billion in direct taxes paid per annum, it is clear that the benefits of the group’s activities are enjoyed through a large and diverse stakeholder base. We refer you to the value added statement in the key relationships section and the community section in Deliver to our beneficiaries for further information.

Our 2015 BBBEE rating has been reaffirmed at level 2, the result of a continued dedicated effort, focus on all areas of the business and an operating philosophy that ensures the BBBEE impacts of each decision the business makes are taken into account. There continues to be significant uncertainty as to what the group’s BBBEE rating will be under the new codes as a result of the uncommercial nature in which they have been drafted, particularly with regard to the subminimum demotions and the change in scoring scales. The group continues to litigate against attempts by various gambling boards to unilaterally impose the achievement of defined levels of empowerment, as measured against the codes, as a licence condition due to the uncertainty and the extent to which the levels achieved are moved out of the group’s control. We remain committed to enhancing the group’s BBBEE credentials in every commercially reasonable way, but cannot expose our licences to regulatory risk against uncertain moving targets.

Product relevance to customer experience

Tsogo Sun continues to reinforce its position as an established household name, in both the corporate and consumer markets in South Africa. The essence of the group’s products remain onsite experiences, as, in order for our customers to consume our product, they need to physically visit our properties, be it for theatre, entertainment, dining, gaming or hospitality.

We continue to invest significantly in both distribution of physical product and maintenance capital expenditure in our various properties, and believe in operating best-in-class products at each relevant price point. In addition, the group continues to allocate significant human and financial resources to systems, ensuring that the offering at each property is relevant to the market it serves.

The current focus remains on expanding and refreshing our casino properties and addressing legacy issues at some of the older hotels, particularly in bathroom infrastructure. During the 2015 financial year we completed the R560 million expansion and redevelopment of the Silverstar Casino and progressed with the R630 million redevelopment of the Gold Reef City Casino and Theme Park. A number of key hotels underwent renovation, in particular Southern Sun Maputo where we spent US$30 million renovating existing rooms and adding 110 rooms and conference facilities. The Palazzo at Montecasino, which is without doubt the most beautiful hotel in Johannesburg, enjoyed a complete rooms refurbishment and the Garden Court De Waal Hotel in Cape Town has been refurbished and relaunched as SunSquare Cape Town.

Operationally, work continues to be done on the refresh of gaming products on our floors and guest facilities and amenities at our hotels. The focus on our food and beverage operations to ensure our delivery is relevant and appealing to our customers and supportive of the gaming and rooms operations is proving successful, with the group reclaiming a reputation for excellence in food and beverage that had not been enjoyed for many years. Most rewardingly the Foundry at Southern Sun Abu Dhabi has been rated as one of the best restaurants in this competitive city, while in South Africa, Level Four at 54 on Bath in Rosebank, the San Deck at the Sandton Sun and Grill Jichana at the Southern Sun Elangeni and Maharani in Durban are all making an impact in their markets.

During the 2015 financial year a large amount of work was completed on ensuring our IT systems remain up to date and are fully supported. Legacy Aristocrat gaming management systems have been replaced with either IGT Advantage or Gamesmart, a process which resulted in a certain amount of operational disruption during the year but is now completed. The redevelopment of the group’s website and booking engine continues and is expected to be completed during the 2016 financial year.

Regulatory compliance

The group enforces a culture of compliance at all levels of the organisation, relating to all relevant laws and regulations. Compliance is not limited to intensive gaming regulation requirements, but also involves having systems and review processes in place to understand and abide by laws in areas as diverse as liquor and fire regulations, health and hygiene standards, labour, competition and consumer practices.

While we respect the important role that the various regulatory bodies play in society and business in general and towards the affairs of the group specifically, we have been, and are still, forced to challenge elements of law and regulation that we believe are misguided or will have unintended adverse consequences for the group and its stakeholders. We will continue to defend our commercial rights while maintaining a cordial and co-operative relationship with various levels of government.

Human resources

Tsogo Sun aims to recruit staff with the best skills and attitudes available and provide an enabling and positive work environment. The Tsogo Sun Academy, which controls all aspects of the group’s employee training and development programmes, is a significant asset to ensure staff are properly equipped for the work environment with R107 million spent during the 2015 financial year on training. We firmly believe that engagement is often as important to derive the best performance from a workforce as are the levels of remuneration. The results of the staff engagement survey carried out during the year were positive and issues identified are in the process of being addressed.

The remuneration report highlights the group’s philosophy towards remuneration and incentivisation, ensuring we retain valuable talent.

Growth

The value of a business is the present value of the cash flows that can be generated by the assets owned or controlled. Accordingly, the only true measure of growth for our business over time is its growth in free cash flow.

Our free cash flow reduced marginally by 1% to R1.8 billion for the 2015 financial year mainly due to increased finance costs following the share buy-back. The coming year may see limited growth in free cash flow as we incur additional interest on higher net debt levels and complete major maintenance capital expenditure projects, offset by the anticipated growth in cash generated from operations. We are, however, comfortable that these investments, including the share buy-back, will yield acceptable future returns.

Organic growth

The macro-economic environment remains subdued and this is not expected to materially change in the short to medium term. The gaming win growth of 2% was impacted by a slow performance in both slots and tables. The performance at the majority of the group’s properties was stronger than this average may indicate, but was dragged down by particularly weak performances at Hemingways in East London and Goldfields in Welkom due to poor local economic conditions and Gold Reef City and Silverstar suffering construction and systems change-related disruptions. Overall owned occupancies at 61.6% declined by some 2pp and are still well below normal long-term levels of around 68%. The South African government introduced austerity measures in its travel spend and the group experienced a reduction of approximately 100 000 room nights in this segment during the financial year. Southern Sun Maputo was closed for five months during the refurbishment and expansion of the hotel, as was the Garden Court De Waal in Cape Town. Overall owned average room rates increased by 5% and consequently Revpar grew by a limited 2% to R583.

The group’s financial results for the 2015 financial year reflect an income growth of 5% with Ebitdar flat on the prior year assisted by the acquisitions implemented in the prior and current year. Operating, finance and taxation costs are strictly monitored and benchmarked across the group, and continued maintenance capital expenditure is vital to maintaining and improving the group’s asset base.

In the longer term a recovery in consumer and business confidence, driving growth in leisure spend and corporate travel respectively remains the largest growth opportunity for the group. With our unparalleled asset base, Tsogo Sun stands to benefit significantly from the high levels of operational gearing in the industries in which it operates and should see a significant increase in operating cash flows if organic revenue growth, even marginally above inflationary levels, can be sustainably achieved. We maintain this position and continue to build on this asset base where possible.

Inorganic growth

Inorganic growth is pursued through a combination of expanding our existing facilities, new developments and acquisitions. The group invested R2.0 billion during the 2015 financial year in acquiring hotel assets and businesses, expanding hotels and casino properties, acquiring non-controlling interests shareholdings in our existing businesses and shareholdings in other businesses. For detail of the transactions refer to the Inorganic growth section.

In addition to the capital invested in the growth strategy, the group managed the exit of SABMiller from its long-term 39.6% shareholding in the group, including a specific repurchase of 133.6 million Tsogo Sun ordinary shares for R2.8 billion in August 2014. The shares were acquired at a price of R20.96 per share representing an 18.6% discount to the final book build price achieved on the sale of the SABMiller investment of R25.75 per share.

The group continues to pursue additional opportunities with the most significant being as follows:- the group entered into a transaction with Sun International Limited and Grand Parade Investments Limited for the acquisition of a 40% equity interest in each of SunWest International Proprietary Limited and Worcester Casino Proprietary Limited for an aggregate R2 185 million. The acquisition which was subject to the fulfilment of conditions precedent, including the approvals of the provincial gambling and the competition authorities, was subsequently cancelled as the approvals would not have been obtained before the expiry of the agreements. This opportunity and the opportunity to relocate one of the smaller casinos into the Cape Metropole remain firmly on the group’s agenda;

- the Mpumalanga Gaming Board withdrew the second request for proposal for the fourth casino licence in the province. The group is pursuing a legal challenge in this regard following the submission of a bid proposal in response to the request;

- we continue to refine the design of the Suncoast Casino and retail expansion and expect to break ground on this development next year. With 50 000m2 of retail, new restaurants and an expanded and enhanced casino offering we believe this development will add substantial value to the already successful Suncoast property; the group has announced a new 500-room hotel complex in the Cape Town city centre, with the opening scheduled for the third quarter of 2017; and

- the group is considering creating an entertainment and hospitality focused Real Estate Investment Trust (‘REIT’), into which it would transfer its extensive owned hotel, retail and office property portfolio. Evaluation of this opportunity continues and no firm decision has been made in this regard.

South Africa and the rest of the African continent continue to offer good investment opportunities and these are being pursued. These opportunities are evaluated by the group with a strong focus on ensuring that we are capable of operating them successfully, that they are priced for value and that they do not impinge on our sustainability.

As we have said before, provided the macro-economy does not go into free fall and that regulatory changes are well considered by the relevant authorities, we remain confident of generating significant value for our stakeholders going forward.

Appreciation

We wish to extend our appreciation to the board, management and the staff of the group for their efforts during the year. More importantly, we wish to extend a word of encouragement to the management and staff of Tsogo Sun to remain focused on delivering the group strategy. Tsogo Sun remains a group with irreplaceable assets and people.

|

|