Corporate governance

GOVERNANCE ANDREMUNERATION

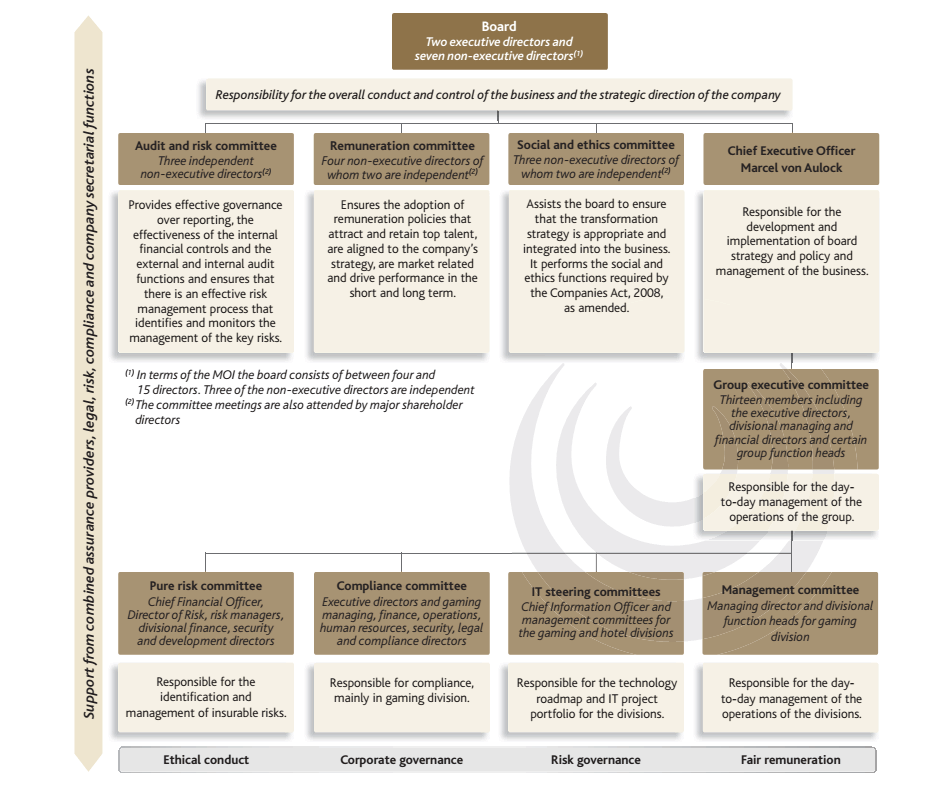

Our governance framework

The board and board committees

The board maintains full and effective control over the company and is accountable and responsible for its performance and compliance. The board reviews the strategic priorities of the group, determines the investment policies and delegates to management the detailed planning and implementation of the objectives and policies in accordance with appropriate risk parameters. The board monitors compliance with policies and achievement against objectives by holding management accountable for its activities through quarterly performance reporting and budget updates.

The board charter codifies the board’s composition, appointment, authorities, responsibilities and processes and sets out the fiduciary duties of the directors of the company. It provides the board with a mandate to exercise leadership, determine the group’s vision and strategy and monitors operational performance.

The board governs through clearly mandated board committees. Each committee has specific written terms of reference approved by the board and adopted by the committee. All committee chairmen report orally on the proceedings of their committees at the board meetings. Evaluation of the board and the board committees is entrenched in the board charter and terms of reference and is carried out annually.

Our board

1. |

MN VON AULOCK (41)CA(SA)Executive Director – Chief Executive Officer Date appointed: 1 April 2009 Marcel von Aulock served his articles at PwC and joined Tsogo Sun as Group Financial Manager in 1999. In 2004 he was promoted to Group Strategic Planning Director. In 2009 he was appointed Chief Financial Officer and on 30 September 2011 he assumed the role of Chief Executive Officer. |

2. |

RB HUDDY (46)CA(SA)Executive Director – Chief Financial Officer Date appointed: 31 October 2011 Rob Huddy served his articles at PwC and joined Tsogo Sun in 1997. He held various management positions prior to being appointed Financial Director – Hotels Offshore in 2006 and Financial Director – Hotels South Africa in 2009. On 30 September 2011 he assumed the role of Chief Financial Officer. |

|

3. |

JA COPELYN (65)BA(Hons), BProcNon-executive Chairman and member of the remuneration committee Date appointed: 13 August 2003 John Copelyn joined HCI as Chief Executive Officer in 1997. He was previously General Secretary of the Southern African Clothing and Textile Workers Union from 1974 before becoming a member of parliament in 1994. He currently holds various directorships and is Non-executive Chairman of e.tv. |

4. |

MA GOLDING (55)BA(Hons)Non-executive Director Date appointed: 30 April 2004 Marcel Golding runs a family investment office. Prior to this he was Chairman of HCI and Chief Executive Officer of e.tv. He was a member of parliament and Deputy General Secretary of the National Union of Mineworkers. He is Chairman of KWV Holdings. |

5. |

VE MPHANDE (57)Elec Eng (Dip)Non-executive Director Date appointed: 3 February 2005 Elias Mphande has served as the National Organising Secretary of the Southern African Clothing and Textile Workers Union, Marketing Director of Viamax Fleet Solutions, Chief Executive Officer of AUTA and the Vukani Group and Chairman of Golden Arrow Bus Services. He was appointed to the HCI board in 2010 as a Non-executive Director and serves on the board of Vukani Gaming Corporation and e.tv. |

6. |

Y SHAIK (57)BA(Law), BProcNon-executive Director, member of the social and ethics committee and Chairman of the remuneration committee Date appointed: 15 June 2011 Yunis Shaik is an admitted attorney of the High Court of South Africa. He is a former Deputy General Secretary of the Southern African Clothing and Textile Workers Union and a director of Workers’ College. He has served as a Senior Commissioner to the KwaZulu-Natal CCMA. He was appointed to the board of HCI in 2005 as lead independent non-executive director of HCI in 2010 and as Executive Chairman in 2014. |

|

7. |

RG TOMLINSON (52)BCom, HDip Personnel ManagementLead Independent Non-executive Director, Chairman of the audit and risk committee and the social and ethics committee and member of the remuneration committee Date appointed: 24 February 2011 Rex Tomlinson was Human Resources Director of Illovo Sugar Limited, before joining Nampak, where he held numerous executive line management roles and was a member of the Nampak Limited board. He joined Liberty Holdings in 2004, was appointed Deputy Chief Executive in 2005 and to the Liberty Holdings board in 2006 where he served until his resignation in 2010. He is a director of Telkom SA SOC Limited and Chairman of three unlisted companies. |

8. |

BA MABUZA (51)BA MBAIndependent Non-executive Director, member of the audit and risk committee Date appointed: 1 June 2014 Busi Mabuza has held various positions in the financial services and energy sectors and is currently a non-executive director at Development Bank of Southern Africa, Industrial Development Corporation and Nehawu Investment Holdings. |

|

9. |

JG NGCOBO (64)Independent Non-executive Director, member of the audit and risk committee, the social and ethics committee and remuneration committeeDate appointed: 24 February 2011 Jabu Ngcobo held the positions of General Secretary of the Southern African Clothing and Textile Workers Union from 1994 to 1999 and the Regional Secretary for Africa of the International Textile Garment and Leather Workers Federation from 1999 to 2006. He was appointed to the board of HCI in 2004 and serves as a director of HCI Coal. |

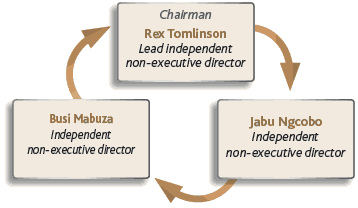

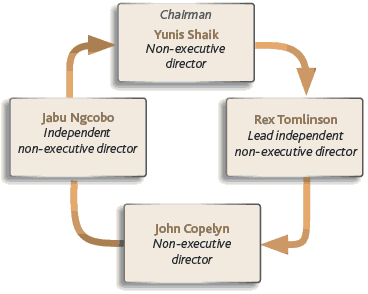

Segregation of duties

The roles of the Chairman and the Chief Executive Officer are separate, with responsibilities divided between them to ensure a balance of power and authority. The Chairman is responsible for providing overall leadership of the board and ensuring that the board performs effectively. The Chief Executive Officer is responsible for the execution of the strategic direction, which is approved by the board, through the delegation of authority.

The Lead Independent Director is Rex Tomlinson who chairs or serves on all of the committees of the board and is therefore well placed to influence the governance of the company and meet his obligations as Lead Independent Director.

The Company Secretary ensures that board procedures and relevant regulations are fully adhered to. The Company Secretary is not a director of the company. The directors have unlimited access to the advice and services of the Company Secretary. The board is satisfied that the Company Secretary is competent and has the appropriate qualifications and experience required by the group. The Company Secretary also acts as secretary for the committees of the board.

All directors have unrestricted access to company records, information, documents and property and unfettered access to management at any time. All directors are entitled, at Tsogo Sun’s expense, to seek independent professional advice on any matters pertaining to the group where they deem this to be necessary.

Board composition and attendance

The composition of the board and of the audit and risk, remuneration and the social and ethics committees is determined by the majority shareholder. Following the disposal of SABMiller of its shareholding, J Davidson, JS Wilson, MI Wyman and JA Mabuza resigned and BA Mabuza was appointed as a director. No independent director has served for more than nine years and the average length of service of independent directors is three years. The board considers that there is an appropriate balance of skills, experience, independence and knowledge among the independent directors. One third of the directors retire by rotation each year in line with the memorandum of incorporation.

During the year there were six board meetings. Individual directors’ attendance at the board and board committee meetings and at the AGM is set out in the table below:

| Board | Audit and risk committee |

Remuneration committee | Social and ethics committee | AGM | |||

| Executive directors | |||||||

| Marcel von Aulock | 6/6 | ✔ | |||||

| Rob Huddy | 6/6 | ✔ | |||||

| Non-executive directors | |||||||

| Chairman | |||||||

| John Copelyn | 6/6 | 2/2 | ✔ | ||||

| Deputy Chairman | |||||||

| Jabu Mabuza | 3/3 | ||||||

| Lead independent | |||||||

| Rex Tomlinson | 6/6 | 3/3 | 2/2 | 2/2 | |||

| Independent | |||||||

| Busi Mabuza | 5/5 | 2/2 | |||||

| Jabu Ngcobo | 6/6 | 3/3 | 2/2 | 2/2 | |||

| Non-independent | |||||||

| John Davidson | 3/3 | 1/1 | |||||

| Marcel Golding | 5/6 | ||||||

| Elias Mphande | 6/6 | ||||||

| Yunis Shaik | 6/6 | 1/1 | 2/2 | 2/2 | ✔ | ||

| Jamie Wilson | 2/3 | ||||||

| Malcolm Wyman | 3/3 |

In addition, the divisional Managing Directors and the Group Human Resources Director attend board meetings, enabling the board to explore specific issues and developments in greater detail.

Audit and risk committee

Key objective:

The provision of effective governance over the appropriateness of the group’s financial and integrated reporting including the adequacy of related disclosures, the performance of both the internal audit function and the external auditor, and the management of the group’s systems of internal control, business risks and related compliance activities.

The committee met three times during the year. The Chief Executive Officer, the Chief Financial Officer, the group’s Director of Risk, the Chief Information Officer and directors from the majority shareholder attend the meetings as permanent invitees, along with external audit and the outsourced internal audit. Other directors and members of management attend as required.

The work of the audit and risk committee during the year focused on:

- review of the risk landscape to which the group is exposed in relation to the group’s risk tolerance and risk appetite levels and evaluation of the appropriateness of management’s responses to the risks;

- oversight of the implementation of the combined assurance model;

- review of IT risks in relation to core operational systems, systems projects and security initiatives;

- review of material legal, legislation and regulatory developments;

- review of and recommendation to the board for approval of the interim and annual results announcements and the annual financial statements and integrated annual report;

- approval of the external audit and internal audit plans;

- evaluation of the independence and effectiveness of, and the fees and terms of engagement of the external auditors;

- evaluation of the effectiveness of the outsourced internal audit function;

- assessment of the internal control environment, particularly in relation to the group’s system on internal financial controls;

- evaluation of the group’s whistle-blowing systems; and

- assessment of the expertise and experience of the Chief Financial Officer.

- Refer to the report of the audit and risk committee of the consolidated financial statements for the year ended 31 March 2015.

Remuneration committee

Key objective:

The committee is empowered by the board to assess and approve the board remuneration strategy for the group, the operation of the company's short-term and long-term incentives for executives across the group, and set short-term and long-term remuneration for the executives directors and members of the executive committee.

The committee met twice during the year. The Chief Executive Officer and the group’s Human Resources Director attend the meetings as permanent invitees, except when issues relating to their own compensation are discussed.

The scope of the remuneration committee’s work during the year included the following matters:- monitoring and providing guidance in matters relating to organisational culture, structures and processes that support the development and retention of people, and the optimisation of their potential;

- ensuring that the priorities of employment equity and skills retention form part of the business plans of the group – enforcing, monitoring and auditing developmsent and progress;

- determining the group’s general policy on executive and senior management remuneration and the specific remuneration packages for the executive directors and other senior executives of the group, and to ensure that they are fairly, competitively but responsibly rewarded for their individual contributions and performance; and

- determining any criteria necessary to measure the performance of executive directors and other senior executives and approving targets for any performance-related pay schemes.

Further details of the group’s remuneration policy and the work of the remuneration committee can be found in the remuneration section.

Social and ethics committee

Key objectives:

The purpose of the committee is to regularly monitor the company’s activities, having regard to any relevant legislation, other legal requirements or prevailing codes of best practice and, in particular, to monitor the group’s compliance with the applicable requirements of Regulation 43 of the South African Companies Act in relation to matters pertaining to social and economic development, good corporate citizenship, environment, occupational health and public safety, labour and employment and the group’s code of ethics and sustainable business practice.

The committee met twice during the year. The Chief Executive Officer, the Chief Financial Officer, the group’s Director of Risk, the group’s Human Resources Director and directors from the majority shareholders attend the meetings as permanent invitees, along with other directors and members of management who attend as required.

The work of the social and ethics committee during the year focused on:- the revisions to the BBBEE codes;

- disputes with government or legislation;

- compliance with regulations;

- socio-economic development and enterprise development;

- environmental management and certification;

- customer satisfaction, loyalty and health and safety and consumer protection;

- job creation, employee health and safety, employee development and employment equity; and

- preferential procurement.

The matters considered during the year are included in the deliver to our beneficiaries section, the product relevance to customer experience section, the regulatory compliance section and the human resources.

The main area of concern discussed by the committee during the year was on the potential impact of the revisions to the BBBEE codes on the current achievements and potentially on casino licences. Refer to the transformation section for more information. The committee discussed matters of dispute with various regulatory bodies and there were no other significant matters of concern raised during the year.

Ethics

The group has an ethics policy and a code of conduct which guides its business practices. It provides guidance on matters such as conflicts of interests, acceptance and giving of donations and gifts, compliance with laws and the dissemination of confidential information.

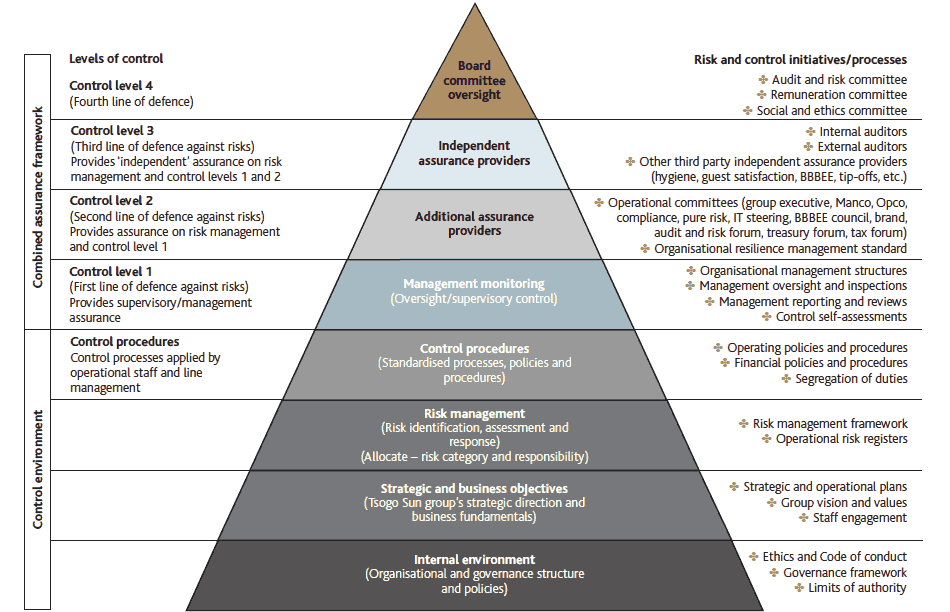

Internal control

The directors are responsible for the group’s systems of internal control. The systems of internal control are designed to manage rather than eliminate risk, and provide reasonable but not absolute assurance as to the integrity and reliability of the financial statements, the compliance with statutory laws and regulations, and to safeguard and maintain accountability of the group’s assets.

The directors have satisfied themselves that adequate systems of internal control are in place to mitigate significant risks identified to an acceptable level. Nothing has come to their attention to indicate that a material breakdown in the functioning of these systems within the group has occurred during the year.

King III application

The King III gap analysis, to review the company’s application of the various principles of King III, was updated during the year. A copy of the full gap analysis is available on the company’s website.

The principles required by King III where application is currently ‘in progress’ are as follows:- a regulatory universe has been defined and a compliance framework is in the process of being incorporated into the combined assurance plan; and

- adoption of the group governance framework will be minuted at subsidiary board meetings.

The principles required by King III where application is ‘applied differently’ are as follows:

|

The major shareholder exercised their prerogative to appoint John Copelyn as the Chairman, representing their interests. As a compensating control, a Lead Independent Director was appointed, namely Rex Tomlinson. | |

|

The major shareholder exercised their prerogative to appoint the directors representing their interests. The majority of the directors are non-executive with three of the non-executive directors being independent. | |

|

Directors are nominated by the major shareholder and appointed at the Annual General Meeting. Formal letters of appointment including the required roles and responsibilities are, however, not issued. |

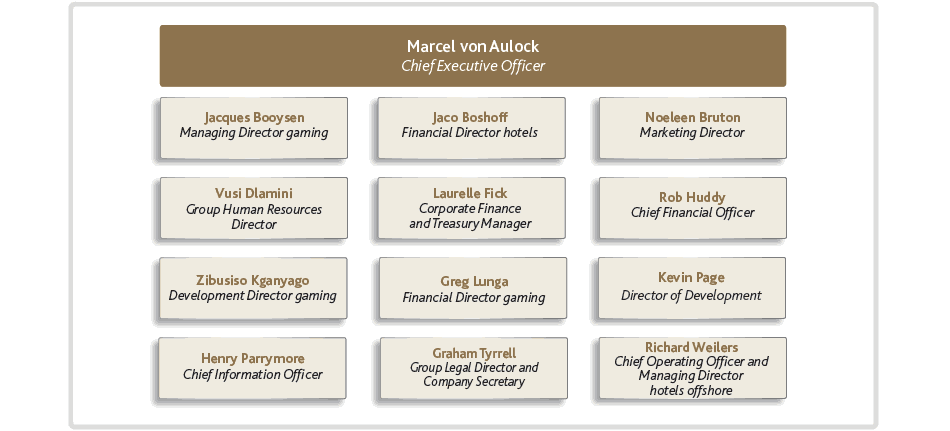

Group executive committee

The board delegates responsibility for determining and implementing the group’s strategy and managing the group to the Chief Executive Officer who is supported by the GEC. The committee coordinates operational execution of the strategy, ensures effective internal controls are functioning and that there is an effective risk management process in operation throughout the group. The members of the GEC at 31 March 2015 were:

IT governance

The board of directors is accountable for IT governance. An IT governance charter has been adopted and approved by the board and takes into account the requirements of King III, globally accepted standards and good practice, together with the performance and sustainability objectives of the group. This charter outlines the decision-making rights and accountability framework for IT. The Chief Information Officer reports directly to the Chief Executive Officer and has responsibility for the ownership and execution of IT governance.

All IT strategies in support of business objectives are debated in divisional management and IT steering committees prior to being presented to the GEC. Once agreed and prioritised these are motivated to the board for approval. All approved investments are tracked through the divisional management and IT steering committees to ensure delivery of business benefit.

Risk management process

The Tsogo Sun board recognises that the management of business risk is crucial to our continued growth and success and this can only be achieved if all three elements of risk – namely threat, uncertainty and opportunity – are recognised and managed in an integrated fashion.

The audit and risk committee is mandated by the board to establish, coordinate and drive the risk process throughout the group. It has overseen the establishment of a comprehensive risk management system to identify and manage significant risks in the operational divisions, business units and subsidiaries. Internal financial and other controls ensure a focus on critical risk areas, are closely monitored and are subject to management oversight and internal audit reviews.

The systems of internal control are designed to manage rather than eliminate risk, and provide reasonable but not absolute assurance as to the integrity and reliability of the financial statements, the compliance with statutory laws and regulations, and to safeguard and maintain accountability of the group’s assets. The board and executive management acknowledge that an integrated approach to the total process of assurance improves the assurance coverage and quality in addition to being more cost-effective and the combined assurance framework is as follows:

Tsogo Sun combined assurance framework

In addition to the risk management processes embedded within the group, the group executive committee identifies, quantifies and evaluates the group’s risks annually utilising a facilitated risk assessment workshop. The severity of risks is measured in qualitative as well as quantitative terms, guided by the board’s risk tolerance and risk appetite measures. The scope of the risk assessment includes risks that impact shareholder value or that may lead to a significant loss, or loss of opportunity. Appropriate risk responses to each individual risk are designed, implemented and monitored.

The risk profiles, with the risk responses, are reviewed by the audit and risk committee at least once every six months. In addition to the group risk assessment, risk matrices are prepared and presented to the audit and risk committee for each operational division. This methodology ensures that identified risks and opportunities are prioritised according to the potential impact on the group and cost-effective responses are designed and implemented to counter the effects of risks and take advantage of opportunities.