Remuneration report

Remuneration philosophy and policy

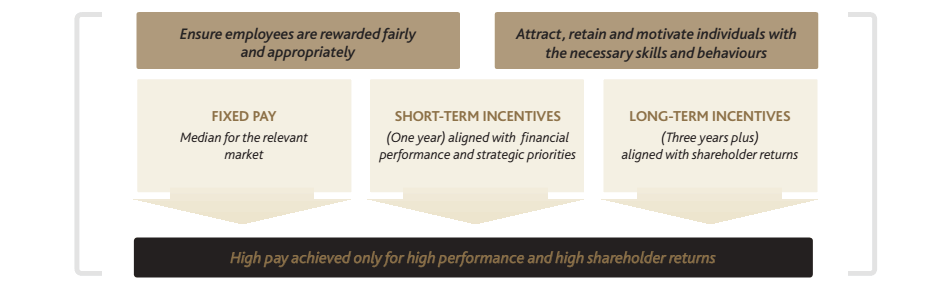

Key tenets of our remuneration philosophy are that we act fairly and responsibly in our approach to employee remuneration and benefits at all times, ensuring our actions are sustainable, that they underscore our objective of being an employer of choice, and are aligned with the strategic and operational requirements of the business.

The objective of the group’s remuneration policy is to ensure that we attract and retain employees of the right calibre and skills and motivate them to achieve exceptional performance aligned with our strategic priorities. We aim to reward employees fairly and equitably through both financial rewards and non-financial benefits such as performance recognition, development and career opportunities. We believe our employees and their representative trade unions, where relevant, value the consistency and predictability of how the terms and conditions of employment are determined, both in times of economic growth and in difficult economic conditions.

Total rewards are set at levels that are competitive within the gaming, entertainment and hospitality sectors and the group utilises market surveys to ensure that the components of the remuneration structure are appropriate. The fixed and variable element mix of the remuneration structure differ depending on the employee grade.

The remuneration committee considers each element of remuneration relative to the market and takes into account the performance of the group and the individual executive in determining both quantum and design. The remuneration committee also considers the total remuneration (fixed pay plus short-term and long-term incentives) that may be earned at various levels of performance.

Senior management and executive remuneration

Short-term incentives reflect a balance between annual financial performance and other specific strategic priorities over which the participant has influence in order to ensure that achievement of short-term financial performance is not at the expense of future opportunities. Performance is measured at Ebitda and adjusted earnings against budget to ensure that both trading and profit post the financing cost of capital allocation decisions are considered. Between 15% and 40% of the potential award is based on the achievement of non-financial strategic priorities dependent on the employee grade. Where relevant and if the information is publicly available, an additional 25% of the potential award is linked to the relative performance of a business unit against a regional or national market set.

The group seeks to ensure an appropriate balance between fixed and performance-related elements of remuneration, and those aspects of the package linked to short-term financial performance and to those linked to longer-term shareholder value creation. The combination of the components ensures that high pay is achieved only for high performance and high shareholder returns. Senior executives have a larger proportion of their potential total remuneration subject to the achievement of performance-based targets. Long-term incentives are either cash-settled, resulting in income statement volatility but no dilutionary impact to shareholders, or, in the case of nominated senior executives, structured as an interest-free facility for the purpose of acquiring shares in the company. The value for the executives arising from the facility is derived from the shares acquired in the market and there will not be a cash cost to the group, as per the existing share appreciation scheme, nor a dilutionary impact to shareholders.

Key elements of remuneration

| Fixed pay | ||||

| Base salaries | Non-executive directors’ fees | Retirement benefits | Other benefits | |

Purpose and link to strategy

|

Provides a fixed level of earnings appropriate to the requirements of the role | Remunerates non-executive directors for their responsibilities and time commitment | Provides the basis for retirement savings | Provides benefits appropriate to the market and the role |

Application dependent on employee type and level

|

All employees | Non-executive directors | All employees entitled to benefits are required to belong to an approved pension/provident fund | All employees entitled to benefits are eligible for membership of an approved medical scheme and other benefits |

Operation and performance measures

|

Base salaries

Base salaries are subject to annual review. Tsogo Sun’s policy is to be competitive at the median level with reference to market practice in companies comparable in terms of size, market sector, business complexity and international scope. However, base salaries of individuals and incumbents in key roles are aligned with the upper quartile level of the market. Group performance, individual performance and changes in responsibilities are also taken into consideration when determining increases to base salaries |

Non-executive directors’ fees

The fees for the non-executive directors have been recommended by the remuneration committee to the board for their approval, taking into account fees payable to non-executive directors of comparable companies and the importance attached to the attraction and retention of high-calibre individuals as non-executive directors. Levels of fees are also set by reference to the responsibilities assumed by the non-executive directors in chairing the board and in chairing or participating in its committees |

Retirement fund membership

Retirement funding for management, who are remunerated on a total package basis, is non-contributory and is included in their total cost of employment. For staff, retirement funding consists of employer and employee contributions dependent on fund membership. The group offers a pension fund (Tsogo Sun Group Pension Fund) and two provident funds (Alexander Forbes Retirement Fund (Provident Section) and Gold Reef Resorts Provident Fund). Other approved funds include union-negotiated funds and funds to which members have historically belonged |

Healthcare

The majority of employees with medical cover belong to the Tsogo Sun Group Medical Scheme, a restricted membership scheme administered by Discovery Health. The scheme offers hospital, chronic illness and day-to-day cover for 4 660 principal members (10 188 beneficiaries) Risk and insured benefitsArising through membership of the group’s pension and provident funds, competitive death, disability and funeral benefits are made available to employees Long-service awardsFull-time employees of the organisation receive long-service awards calculated based on the tenure of the employee linked to their guaranteed package. Employees receive an award for every 10 years of continued service with the group |

| Short-term incentives | Long-term incentives | |||||||||||||

| Annual bonus plan | Executive facility and share appreciation plan Share appreciation plan | |||||||||||||

Purpose and link to strategy

|

Rewards the achievement of annual financial performance balanced with other specific strategic priorities and ensures that above-market pay cannot be achieved unless challenging performance targets are met. The non-financial element ensures that the achievement of short-term financial performance is not at the expense of future opportunities | Long-term incentives are utilised to reward long-term sustainable group performance improvement, retain senior management expertise and ensure that executives and key talent share a significant level of personal risk and reward with the company’s shareholders to align executive pay and long-term value creation for shareholders | ||||||||||||

Application dependent on employee type and level

|

All executives and senior management and selected middle management | Senior executives | Tsogo Sun and ex-Gold Reef (post-merger) executives and selected managers | Pre-merger Gold Reef executives and selected senior managers | ||||||||||

Operation and performance measures

|

Annual cash incentive

Potential bonus earnings are reviewed periodically by the remuneration committee with minimum and maximum bonus percentages of total package set for each broadband level for the achievement of ‘threshold’, ‘on-target’ and ‘stretch target’ performance, based on or above the median being paid in the marketplace. Financial ‘threshold’ target is set at 90% of target with a payout of 0%, ‘stretch target’ is set at 115% of target with a payout of 100%, with interpolation between the points. Bonus awards are based on individual ratings achieved against the targets set for financial performance, relative growth against the market, where relevant, and personal performance. The remuneration committee approves the scheme’s targets and hurdles annually |

On 12 August 2014, a R200 million facility was made available to senior executives for the sole purpose of acquiring shares in the company at R25.75 per share The board determined the allocation of the facility as follows:

The facility is interest-free and has no fixed repayment date but must be repaid if the shares are sold or if the executive leaves the employ of the company. The executives are subject to fringe benefits tax on the facility The executives are not eligible for any new allocations under the existing share appreciation scheme until the loan is repaid in full. Allocations of appreciation units made prior to the provision of the facility remain unaffected |

Tsogo Sun, and historically Gold Reef (in addition to the equity-settled share scheme), have in operation phantom share schemes with cash settlement designed to align the interests of participants with those of the company’s shareholders. The essential elements of these schemes are that the plan is essentially a ‘phantom’ version of a share scheme where each unit (whether an appreciation unit, performance unit or a bonus unit) is in effect linked to an underlying share in Tsogo Sun | |||||||||||

| Appreciation units

Annual allocations of appreciation units at market price are made to executives and selected managers. They are available to be settled on the third anniversaries of their allocation, but must be exercised by the sixth anniversary, or they will lapse. On settlement, the value accruing to participants will be the full appreciation of Tsogo Sun’s share price over the allocation price plus dividends declared and paid post-grant date, which value will be settled in cash. Vesting during the 2015 financial year resulted in a charge of R76 million with a R1 change in the Tsogo Sun share price impacting the charge by R24 million |

Share appreciation units and Gold Reef Share Scheme

The pre-merger Gold Reef long-term incentive plans are in the process of winding down. No options have been granted to existing executive directors or key management The liability for the share appreciation units as at 31 March 2015 is reflected in Long-term incentive liability of this section. Refer to note 36.2 of the annual financial statements for further information on this scheme All of the options in terms of the Gold Reef Share Scheme were exercised by 31 March 2015. Refer to note 36.1 of the annual financial statements for more information on this scheme |

|||||||||||||

Long-term incentive liability – cash-settled

The following table reflects the liability for long-term incentives and summarises details of the bonus units awarded to participants per financial year, the units vested at the end of the period and expiry dates of each allocation for the Tsogo Sun Share Appreciation Bonus Plan:

Tsogo Sun Share Appreciation Bonus Plan

| Appreciation units granted and still outstanding |

Strike price(1) |

Appreciation units vested and still outstanding |

Liability 2015 |

Liability 2014 |

||||

| Grant date | 2015 | 2014 | R | 2015 | 2014 | Expiry date | Rm | Rm |

| 1 April 2007 | – | 307 452 | 19.87 | – | 307 452 | 31 March 2015 | – | 10 |

| 1 April 2009 | – | 922 643 | 15.10 | – | 922 643 | 31 March 2015 | – | 46 |

| 1 April 2010 | 935 811 | 1 545 064 | 15.08 | 935 811 | 1 545 064 | 31 March 2016 | 52 | 77 |

| 1 April 2011 | 3 403 053 | 4 731 076 | 15.06 | 3 403 053 | 4 731 076 | 31 March 2017 | 53 | 67 |

| 1 October 2011 | 1 783 841 | 1 890 337 | 18.78 | 1 783 841 | – | 30 September 2017 | 20 | 15 |

| 1 April 2012 | 7 245 201 | 7 726 516 | 17.66 | 7 245 201 | – | 31 March 2018 | 89 | 56 |

| 1 October 2012 | 253 678 | 263 825 | 19.71 | – | – | 30 September 2018 | 2 | 1 |

| 1 April 2013 | 7 964 198 | 8 401 905 | 24.56 | – | – | 31 March 2019 | 25 | 9 |

| 1 October 2013 | 221 480 | 221 480 | 25.51 | – | – | 30 September 2019 | 1 | * |

| 1 April 2014 | 8 903 555 | – | 25.72 | – | – | 31 March 2020 | 8 | – |

| 1 October 2014 | 154 738 | – | 25.85 | – | – | 30 September 2020 | * | – |

| Liability at 31 March | 250 | 281 | ||||||

| Gold Reef Share Appreciation Bonus Plan | 8 | 12 | ||||||

| Total long-term incentive liabilities as at 31 March | 258 | 293 | ||||||

| Share price utilised to value the liability at 31 March | R27.60 | R27.00 | ||||||

| (1) | Grants prior to merger (24 February 2011) converted based on swap ratio of 3.553 Gold Reef shares for each TSH share |

| * | Amount less than R1 million |

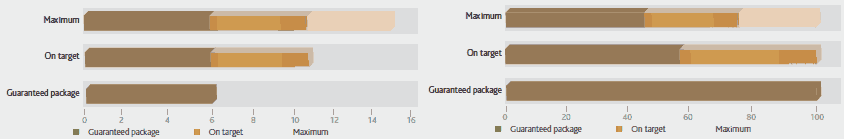

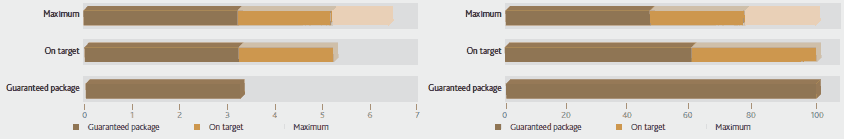

Composition of total remuneration package – executive directors

The charts below provide an indication of the remuneration outcomes for executive directors showing potential total remuneration of maximum on target, and minimum performance levels.

Chief Executive Officer – value of package in Rand (million) |

Chief Executive Officer – composition of package in Rand (%) |

|

|

Chief Financial Officer – value of package in Rand (million) |

Chief Financial Officer – composition of package in Rand (%) |

|

|

The scenario charts assume:

|

|

Employment agreements

Mr JA Mabuza retired from his position as Chief Executive Officer on 30 September 2011. The group entered into a three-year restraint of trade contract that expired on 30 September 2014. In terms of this contract, Mr Mabuza was paid an amount of R8.5 million per annum, in quarterly instalments. In terms of the restraint, Mr Mabuza was prohibited from acting for, consulting to, or advising any other party in the hotel or gaming industry and made himself available to the group for consultation and assistance where required. In addition, although no further long-term incentive allocations were made, his existing allocations vested over that period. There are no other contracts with senior executives with fixed durations.

Non-executive directors

Non-executive directors receive fees for services on board and board committees. Non-executive directors do not receive short-term incentives and do not participate in any long-term incentive scheme, with the exception of Mr JA Mabuza whose existing share appreciation rights vested over the shorter of the vesting period or his restraint of trade ending on 30 September 2014.

| Actual 2014 |

Proposed 2015 |

|

| R’000 | R’000 | |

| Chairman of the board | 855 | 905 |

| Chairman of the audit and risk and social and ethics committees | 490 | 535 |

| Chairman of the remuneration committee | 375 | 400 |

| Non-executive director and member of a board committee | 310 | 330 |

| Non-executive director | 245 | 260 |

Non-executive directors’ remuneration for the year ended 31 March

| Directors’ | Other | 2015 | Directors’ | Other | 2014 | |

| fees | benefits | Total | fees | benefits | Total | |

| Fees and services | (R’000) | (R’000) | (R’000) | (R’000) | (R’000) | (R’000) |

| Paid by subsidiaries | ||||||

| JA Copelyn | 814 | – | 814 | 762 | – | 762 |

| J Davidson(1) | 145 | – | 145 | – | – | – |

| JA Mabuza(2) | – | 28 198 | 28 198 | – | 21 526 | 21 526 |

| BA Mabuza(3) | 135 | – | 135 | – | – | – |

| MJA Golding | 234 | – | 234 | 219 | – | 219 |

| EAG Mackay(4) | – | – | – | 275 | – | 275 |

| JS Wilson(5) | 115 | – | 115 | 111 | – | 111 |

| VE Mphande | 234 | – | 234 | 219 | – | 219 |

| MI Wyman(2) | 115 | – | 115 | 219 | – | 219 |

| RG Tomlinson | 468 | – | 468 | 438 | – | 438 |

| JG Ngcobo | 295 | – | 295 | 275 | – | 275 |

| Y Shaik | 356 | – | 356 | 331 | – | 331 |

| 2 911 | 28 198 | 31 109 | 2 849 | 21 526 | 24 375 |

(1) Appointed 17 January 2014 and resigned 28 August 2014

(2) Resigned 28 August 2014

(3) Appointed 3 June 2014

(4) Deceased 18 December 2013

(5) Appointed 2 April 2013 and resigned 28 August 2014

Directors and senior management

Executive directors’ remuneration for the year ended 31 March

| Basic | Short-term | Long-term | 2015 | ||

| remuneration | Benefits | incentives(1) | incentives | Total | |

| (R’000) | (R’000) | (R’000) | (R’000) | (R’000) | |

| Paid by subsidiaries | |||||

| MN von Aulock | 5 114 | 1 100 | 4 768 | 7 877 | 18 859 |

| RB Huddy | 2 663 | 610 | 2 033 | 4 649 | 9 955 |

| 7 777 | 1 710 | 6 801 | 12 526 | 28 814 |

| Basic | Short-term | Long-term | 2014 | ||

| remuneration | Benefits | incentives(2) | incentives | total | |

| (R’000) | (R’000) | (R’000) | (R’000) | (R’000) | |

| Paid by subsidiaries | |||||

| MN von Aulock | 4 798 | 1 033 | 5 313 | 3 048 | 14 192 |

| RB Huddy | 2 500 | 574 | 2 175 | 329 | 5 578 |

| 7 298 | 1 607 | 7 488 | 3 377 | 19 770 |

(1) Short-term incentives paid relate to the achievement against target for 2014

(2) Short-term incentives paid relate to the achievement against target for 2013

Other key management and prescribed officers’ remuneration for the year ended 31 March

| Basic | Short-term | Long-term | Termination | 2015 | ||

| remuneration | Benefits | incentives(1) | incentives | benefits | Total | |

| (R’000) | (R’000) | (R’000) | (R’000) | (R’000) | (R’000) | |

| Paid by subsidiaries | ||||||

| J Booysen | 3 139 | 899 | 2 085 | 2 255 | – | 8 378 |

| RF Weilers | 4 078 | 915 | 1 700 | 6 289 | – | 12 982 |

| 7 217 | 1 814 | 3 785 | 8 544 | – | 21 360 |

| Basic | Short-term | Long-term | Termination | 2014 | ||

| remuneration | Benefits | incentives(2) | incentives | benefits | Total | |

| (R’000) | (R’000) | (R’000) | (R’000) | (R’000) | (R’000) | |

| Paid by subsidiaries | ||||||

| J Booysen | 3 092 | 526 | 2 706 | 347 | – | 6 671 |

| RA Collins(3) | 1 381 | 247 | 2 841 | 21 716 | 22 315 | 48 500 |

| RF Weilers | 4 241 | 456 | 2 411 | 3 422 | – | 10 530 |

| GI Wood(3) | 1 180 | 190 | 2 148 | 11 861 | 16 363 | 31 742 |

| 9 894 | 1 419 | 10 106 | 37 346 | 38 678 | 97 443 |

(1) Short-term incentives paid relate to the achievement against target for 2014

(2) Short-term incentives paid relate to the achievement against target for 2013

(3) Resigned 31 August 2013

IFRS 2 Share-based Payment charge expensed during the year ended 31 March

| 2015 | 2014 | |

| (R’000) | (R’000) | |

| MN von Aulock | 53 859 | – |

| J Booysen | 26 348 | – |

| RB Huddy | 15 415 | – |

| FV Dlamini | 13 118 | – |

| GD Tyrrell | 9 060 | – |

| 117 800 | – |